Back Taxes Never

Go Away On Their Own!

If the IRS is knocking on your door, Our Tax Resolution Team can help you find relief—fast!

Will an IRS wage garnishment leave you unable to pay your bills?

If this is you...

✔️You open an IRS letter and your heart sinks. That feeling of dread never seems to go away.

✔️You're losing sleep, worrying about how you'll ever pay back what you owe the IRS.

✔️Penalties and interest are piling up, making your tax debt feel like an unstoppable monster.

✔️The thought of talking to an IRS agent makes you break out in a cold sweat.

✔️You hear about people negotiating with the IRS, but it seems impossible for someone like you.

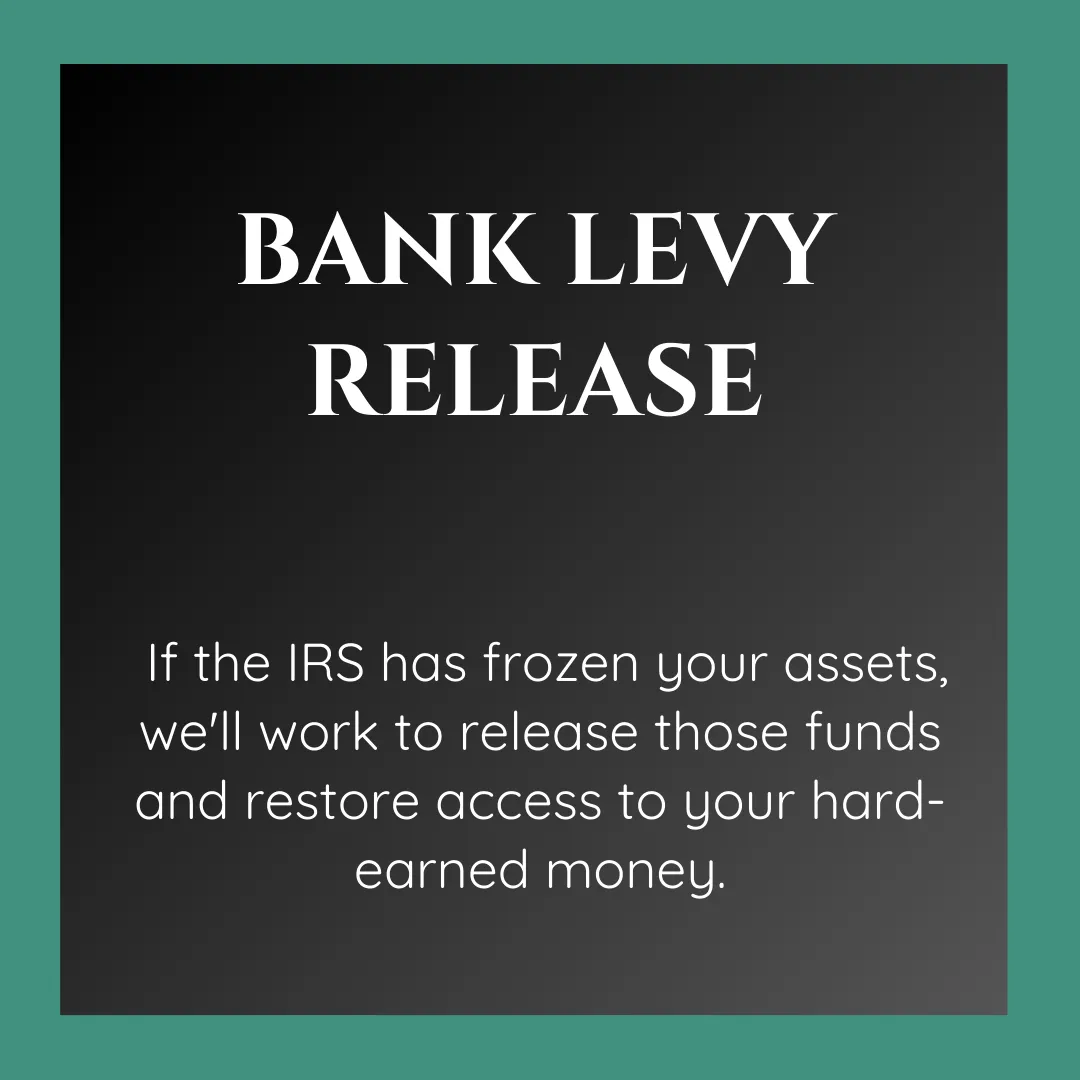

✔️You're afraid of wage garnishment, bank levies, or even losing your property because of tax problems.

✔️You've tried handling your tax situation on your own, but it's only made things worse.

...Then Express Tax Rescue is here to help

We understand the stress, fear, and confusion that IRS problems cause.

Our expert team has:

✔️Decades of combined experience navigating the IRS system.

✔️A deep understanding of tax laws and how to secure the best possible outcome for our clients.

✔️Proven strategies for penalty abatement, payment plans, Offers in Compromise, and more.

Here’s How We Help You Get Your Life Back

The IRS is a financial juggernaut that doesn’t care about the people behind the financial struggles; they simply want their money.

At Express Tax Rescue, we help shield our clients from this overbearing government agency to help them overcome financial hurdles and stressful times with years of hands-on tax experience!

Most of this takes place without you ever coming to our offices. We live in a day and age where technology makes it easy for us to represent you no matter where you reside. Of course, you can always come to our offices if you prefer, whatever is more convenient for you.

TAX NEWS & ARTICLES

Stay informed, stay engaged! Dive deeper into our latest News and Articles.

Dealing with IRS Wage Garnishment? Here’s How to Halt It and Take Charge

When the IRS seizes a portion of your hard-earned income, it can feel daunting and financially taxing. However, it’s important to recognize that you have alternatives and solutions to stop IRS wage garnishment and reclaim your financial stability.

If you find yourself facing IRS wage garnishment, our aim is to equip you with the information and support you need to navigate this tough situation. Let’s explore what IRS wage garnishment is, why it happens, and, most importantly, the effective strategies you can employ to put an end to it.

What is IRS Wage Garnishment?

IRS wage garnishment is a legal measure the IRS employs to recover unpaid taxes. Notably, the IRS does not require a court order to initiate wage garnishment.

You will receive notifications if the IRS plans to garnish your wages. These notices will include a Final Notice of Intent to Levy, indicating their intent to proceed. If you do not respond or take action within a specified period, they will begin garnishing your earnings.

The Consequences of IRS Wage Garnishment

Wage garnishment directly reduces your net pay, making it difficult to maintain a reasonable standard of living or even manage essential expenses.

Additionally, IRS wage garnishment can negatively impact your credit rating, complicating future loan applications and the interest rates you might receive.

It can also lead to strained relationships and increased stress. Moreover, your professional reputation may suffer if colleagues learn about the garnishment.

How to Halt IRS Wage Garnishment

Halting IRS wage garnishment involves taking proactive measures and implementing effective strategies. Here are crucial steps you can take:

Respond to IRS Notifications: It’s vital to promptly address all IRS communications regarding wage garnishment. Ignoring these notices will worsen the situation. You can request a collection due process hearing to discuss your case.

Consider Payment Options: The IRS provides various payment plans to settle your tax debt. This may include an installment agreement, allowing you to pay off the debt over time, or an offer in compromise, which lets you settle for less than the total amount owed.

Request a Hardship Exemption: If the garnishment causes significant financial hardship, you may be eligible for a hardship exemption. This can temporarily pause your garnishment or reduce the amount deducted from your paycheck.

Address Tax Discrepancies: If you believe there’s an error in the amount owed, it’s essential to address it swiftly. Disputing the tax assessment through the correct channels can halt the wage garnishment until the issue is resolved.

Seek Professional Help: Managing tax debt on your own can be complex and overwhelming. Consider hiring a reputable tax expert who can guide you through the process, advocate for your interests, and negotiate with the IRS on your behalf. A tax professional can alleviate the burden of IRS dealings and work towards the best possible outcome, saving you both time and money.

The Advantage of Express Tax Rescue

Engaging a tax professional is crucial for stopping IRS wage garnishment and taking control of your financial future.

Erika Jones’s expertise and proven success in negotiations with the IRS distinguish him as a reliable advisor in resolving wage garnishment challenges.

Her extensive knowledge allows her to navigate complex tax issues and explore every possible avenue for the best resolution tailored to your situation.

When you team up with Express Tax Rescue, you gain a dedicated partner committed to advocating for your rights. Express Tax Rescue will negotiate with the IRS on your behalf and investigate all available options to find the optimal resolution for your unique case.

Don’t let the anxiety of wage garnishment dictate your life. Reach out to Express Tax Rescue today for a risk-free consultation and take back control of your financial future!

EXPRESS TAX RESCUE: SOLUTIONS YOU DESERVE. RESULTS YOU NEED

Services We Offer

CALL US FOR A FREE CONSULTATION

678-834-8400

Let Us Deal With The IRS For You

Results: We work with you on a personal level to determine the best solutions for your unique needs, then leverage our seasoned expertise to achieve the best possible results. Relationships We are your trusted partner in success. Our firm is large enough to offer a full range of professional services at a fair price, but small enough to give you the individual attention that you deserve. Relief: Rest assured that when a need arises, our firm is ready and capable to handle everything for you so you can focus on what matters most to you.

As CEO of Easy E's Express Taxes, Erika Jones spearheads growth and innovation for the firm’s suite of personalized tax planning, strategic advisory and preparation services for individuals and diverse businesses at all stages. Combining over 15 years of taxation expertise, Erika left a career as a Chemist to found Easy E's Express Taxes in 2013 – turning complexity and anxiety around navigating evolving codes into confidence and clarity for hundreds of clients through bespoke automation tools and coaching.

From ensuring college students maximize returns to guiding enterprises through international expansion considerations lowering multi-market obligations…Erika leads with empathy, responsiveness and technically proficiency earning contracts with corporate government entities for tax planning and business coaching. Outside optimizing Easy Es Express Taxes’ systems and capabilities empowering further access, you’ll find Erika paying it forward – actively mentoring minority women entrepreneurs on everything from pricing strategy to leading strategic program launches taking purpose-born ideas into viable businesses uplifting their whole locales for generations.