Back Taxes Never

Go Away On Their Own!

If the IRS is knocking on your door, Our Tax Resolution Team can help you find relief—fast!

Will an IRS wage garnishment leave you unable to pay your bills?

If this is you...

✔️You open an IRS letter and your heart sinks. That feeling of dread never seems to go away.

✔️You're losing sleep, worrying about how you'll ever pay back what you owe the IRS.

✔️Penalties and interest are piling up, making your tax debt feel like an unstoppable monster.

✔️The thought of talking to an IRS agent makes you break out in a cold sweat.

✔️You hear about people negotiating with the IRS, but it seems impossible for someone like you.

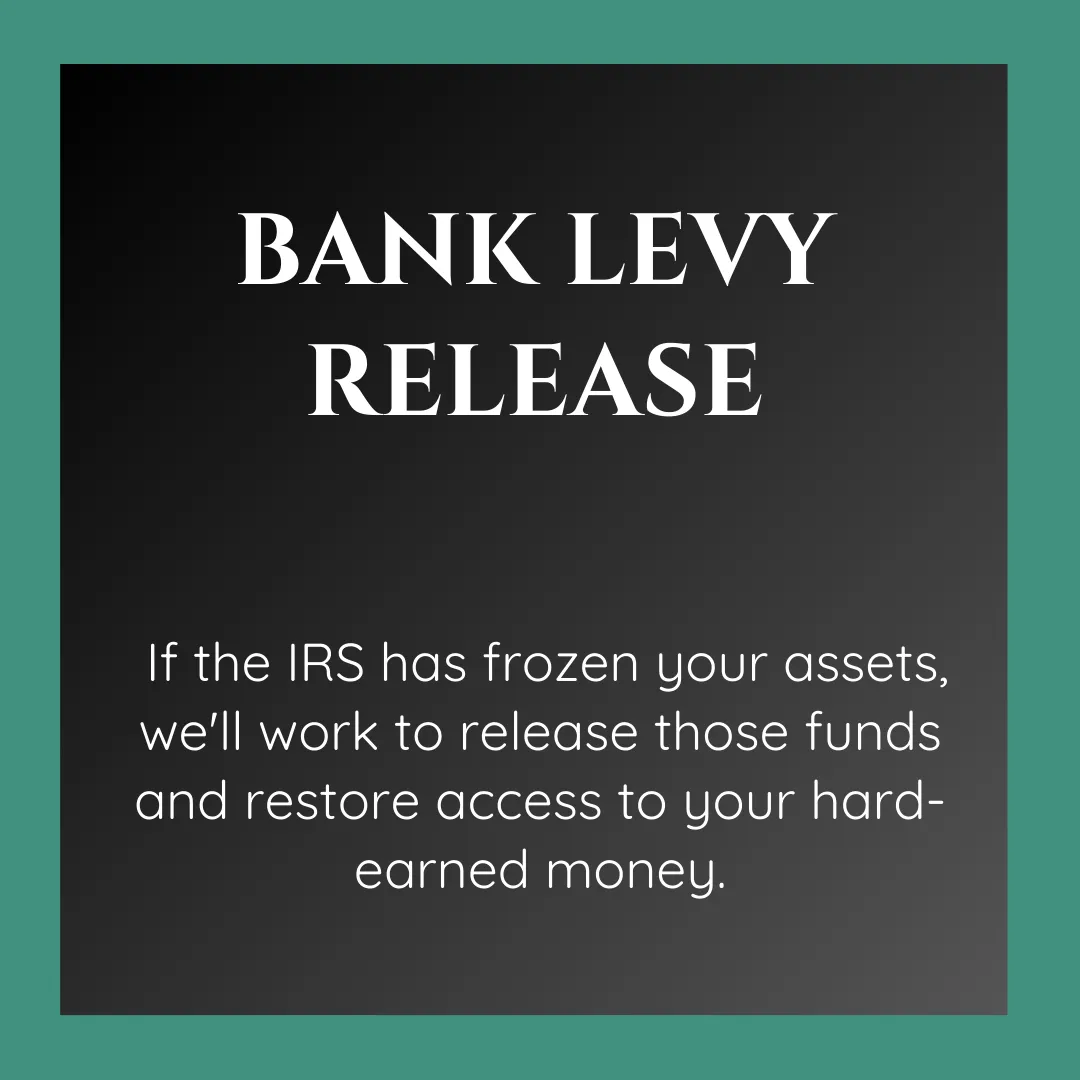

✔️You're afraid of wage garnishment, bank levies, or even losing your property because of tax problems.

✔️You've tried handling your tax situation on your own, but it's only made things worse.

...Then Express Tax Rescue is here to help

We understand the stress, fear, and confusion that IRS problems cause.

Our expert team has:

✔️Decades of combined experience navigating the IRS system.

✔️A deep understanding of tax laws and how to secure the best possible outcome for our clients.

✔️Proven strategies for penalty abatement, payment plans, Offers in Compromise, and more.

Here’s How We Help You Get Your Life Back

The IRS is a financial juggernaut that doesn’t care about the people behind the financial struggles; they simply want their money.

At Express Tax Rescue, we help shield our clients from this overbearing government agency to help them overcome financial hurdles and stressful times with years of hands-on tax experience!

Most of this takes place without you ever coming to our offices. We live in a day and age where technology makes it easy for us to represent you no matter where you reside. Of course, you can always come to our offices if you prefer, whatever is more convenient for you.

TAX NEWS & ARTICLES

Stay informed, stay engaged! Dive deeper into our latest News and Articles.

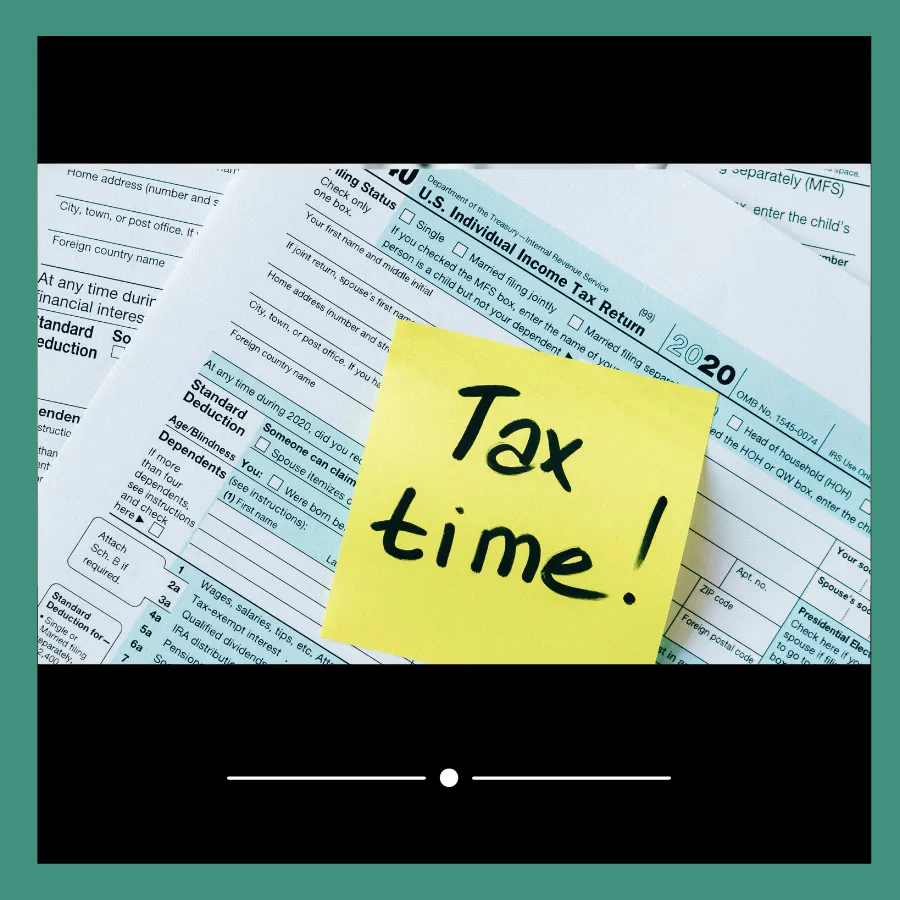

Understanding the LT11 Letter: Urgent Action Required

Receiving an LT11 letter from the IRS can be extremely distressing. This notification serves as a critical warning that the IRS is preparing to take stringent measures to recover unpaid taxes. If you find yourself in possession of this letter, it's vital to comprehend its significance and the urgency of responding promptly.

What is an LT11 Letter?

An LT11 letter, formally known as the "Final Notice of Intent to Levy and Notice of Your Right to a Hearing," is issued by the IRS when you have overdue taxes and have failed to respond to earlier notices.

This letter signifies that the IRS is ready to initiate asset levies, meaning they can legally confiscate your belongings to settle your tax liabilities. This may include funds in your bank accounts, a portion of your wages, your home, or other valuable assets.

Potential Consequences of Ignoring This Notice

Ignoring an LT11 letter can lead to serious repercussions, such as:

Bank Account Seizures: The IRS can freeze your accounts and withdraw funds directly.

Wage Garnishment: A portion of your paycheck may be sent directly to the IRS by your employer.

Property Confiscation: The IRS has the authority to seize your home, car, or other valuable items.

Credit Damage: A levy or lien can significantly harm your credit score, making it more difficult to secure loans or credit in the future.

The Importance of Timely Response

The LT11 letter allows for a 30-day window to respond. During this time, you have the right to request a Collection Due Process (CDP) hearing. This hearing provides an opportunity to contest the proposed levy, suggest an alternative payment plan, or dispute the debt amount. Failing to act within this timeframe means the IRS will begin the levy process, severely limiting your options for resolution.

The Benefits of Seeking Professional Guidance

Navigating tax issues with the IRS can be complicated, and attempting to handle it on your own can lead to costly mistakes.

A tax resolution professional has the expertise and experience to help you effectively manage this challenging situation.

Advantages of Professional Assistance:

Skilled Negotiation: A tax expert can negotiate with the IRS on your behalf to secure favorable terms.

Strategic Solutions: They can create a tailored plan to address your tax issues without causing financial distress.

Protection of Rights: Professionals ensure that your legal rights are safeguarded throughout the resolution process.

If you have received an LT11 letter, do not hesitate.

Contact Express Tax Rescue today.

Erika Jones is a knowledgeable tax resolution specialist ready to assist you in navigating your tax challenges and achieving the best possible resolution.

Reach out to Express Tax Rescue NOW at (678) 834-8400 to safeguard your income and assets from IRS action.

EXPRESS TAX RESCUE: SOLUTIONS YOU DESERVE. RESULTS YOU NEED

Services We Offer

CALL US FOR A FREE CONSULTATION

678-834-8400

Let Us Deal With The IRS For You

Results: We work with you on a personal level to determine the best solutions for your unique needs, then leverage our seasoned expertise to achieve the best possible results. Relationships We are your trusted partner in success. Our firm is large enough to offer a full range of professional services at a fair price, but small enough to give you the individual attention that you deserve. Relief: Rest assured that when a need arises, our firm is ready and capable to handle everything for you so you can focus on what matters most to you.

As CEO of Easy E's Express Taxes, Erika Jones spearheads growth and innovation for the firm’s suite of personalized tax planning, strategic advisory and preparation services for individuals and diverse businesses at all stages. Combining over 15 years of taxation expertise, Erika left a career as a Chemist to found Easy E's Express Taxes in 2013 – turning complexity and anxiety around navigating evolving codes into confidence and clarity for hundreds of clients through bespoke automation tools and coaching.

From ensuring college students maximize returns to guiding enterprises through international expansion considerations lowering multi-market obligations…Erika leads with empathy, responsiveness and technically proficiency earning contracts with corporate government entities for tax planning and business coaching. Outside optimizing Easy Es Express Taxes’ systems and capabilities empowering further access, you’ll find Erika paying it forward – actively mentoring minority women entrepreneurs on everything from pricing strategy to leading strategic program launches taking purpose-born ideas into viable businesses uplifting their whole locales for generations.